A CPA firm creates value by offshoring book-keeping and payroll processing

A California-based CPA firm used a dedicated Offshore Team to support its client work of book-keeping and payroll processing.

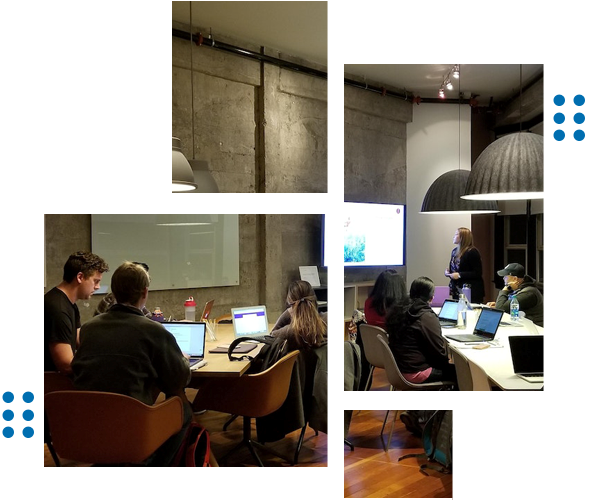

Initially, Talentscale facilitated a hands-on training of its Offshore Team by the CPA firm’s Manager. Talentscale also assisted the CPA firm in defining process workflows, with activities drilled down to specific tasks. This helped in standardizing the activities, minimizing process variations and reducing the CPA firm Manager’s involvement only to handle exceptional situations or specific queries from the Offshore Team and to review the work performed.

A client-wise calendar was setup; tasks were assigned and tracked using a Task Management tool; access to third-party accounting & payroll software was provisioned and work was commenced. A dashboard was designed to offer detailed work status regularly to the CPA firm’s Manager as well as the Principal.

By offshoring their work, the CPA firm not only enhanced its capabilities to take on more client projects, but also improved its Gross Profit Margins for such work, due to lower staff costs offered by Talentscale.

A CPA firm successfully uses an Offshore Team to manage its workload during the Tax season.

A California-based CPA firm engaged a dedicated Offshore Team for a temporary pre-agreed period of 3 months, to manage the peak workload of tax preparation and submissions for its clients.

A Senior Associate from the CPA firm initially trained the Offshore Team in getting to know the tax preparation & filing processes, and getting comfortable in using the tax preparation software. Talentscale assisted the CPA firm in documenting the flow of process activities and work instructions for reference by the Offshore Team.

The CPA firm used a “follow-the-sun" operating model, wherein the Offshore Team completed their assigned tasks overnight and submitted their working papers for review to the CPA firm early in their morning. Review comments were again addressed during CPA firm’s non-working hours and the work was resubmitted. This ensured that work was carried out non-stop, ensuring a faster turnaround of deliverables.

Thus, offshoring not only helped the CPA firm in successfully managing the pressures of the tax filing season, it also enhanced their client satisfaction scores due to faster turnarounds possible by leveraging work performed in a different time zone.

A CPA firm drives efficiencies by outsourcing work requiring specific skills

A California-based CPA firm outsourced routine, repetitive tasks of their client audit projects to drive efficiencies and create value.

The CPA firm evaluated specific tasks of their audit engagements such as tracking data & evidence collection, monitoring project status, performing specific tasks defined in work programs, documenting work performed, etc., and determined that outsourcing such tasks to the Talentscale team will not only free up their staff to focus on other tasks requiring their expertise, but will also reduce the cost of delivering audit projects, by leveraging upon Talentscale’s lower staff costs.

The CPA firm engaged Talentscale’s experienced team members on specific projects, as per their need at an hourly fixed cost, realising efficiencies and improving gross margins of their projects.